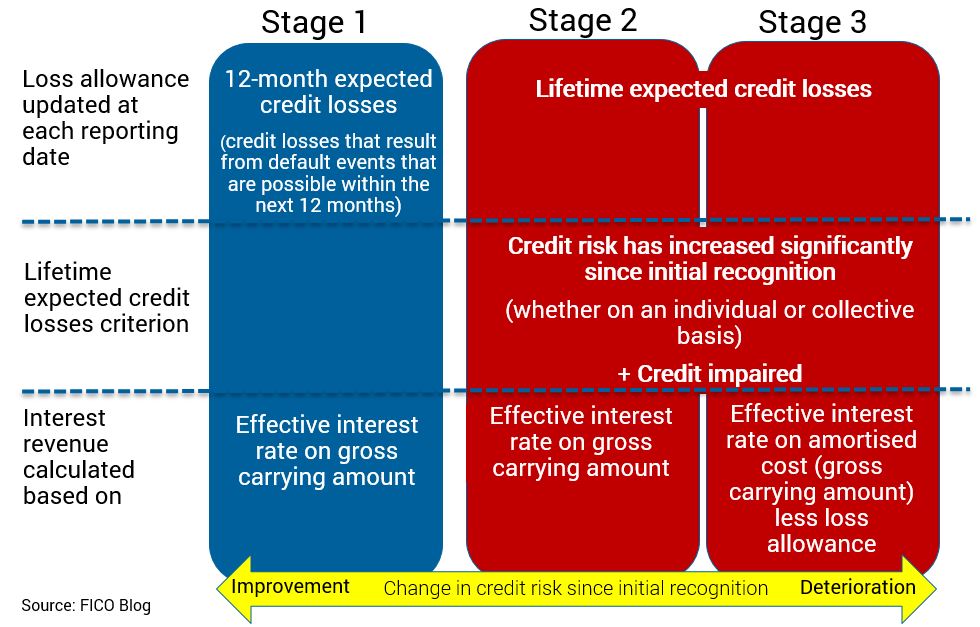

Risks | Free Full-Text | A Forward-Looking IFRS 9 Methodology, Focussing on the Incorporation of Macroeconomic and Macroprudential Information into Expected Credit Loss Calculation

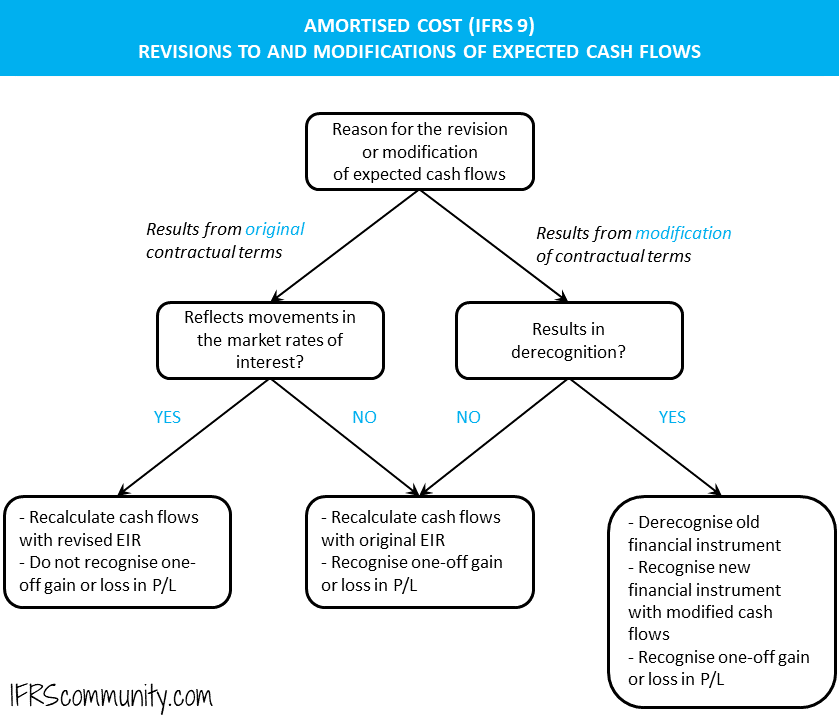

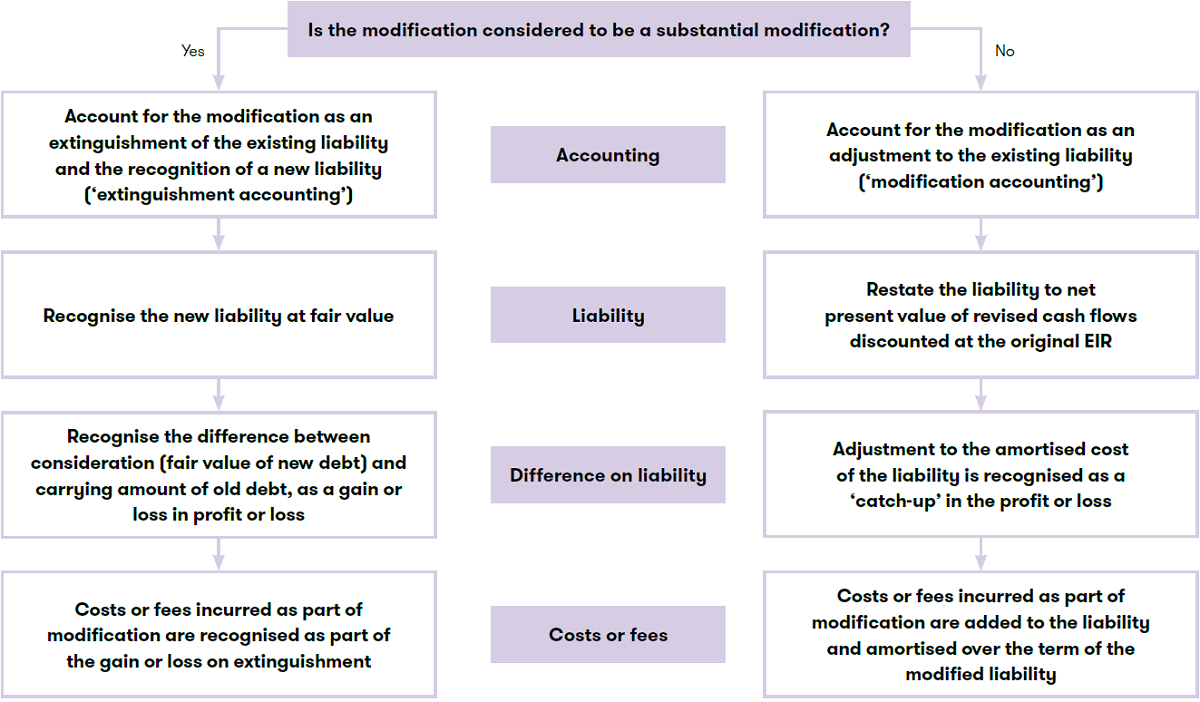

FAQ 4.1.3 – How should an entity account for changes to the cash flows on a debt instrument measured at amortised cost or fair value through other comprehensive income (FVOCI)?

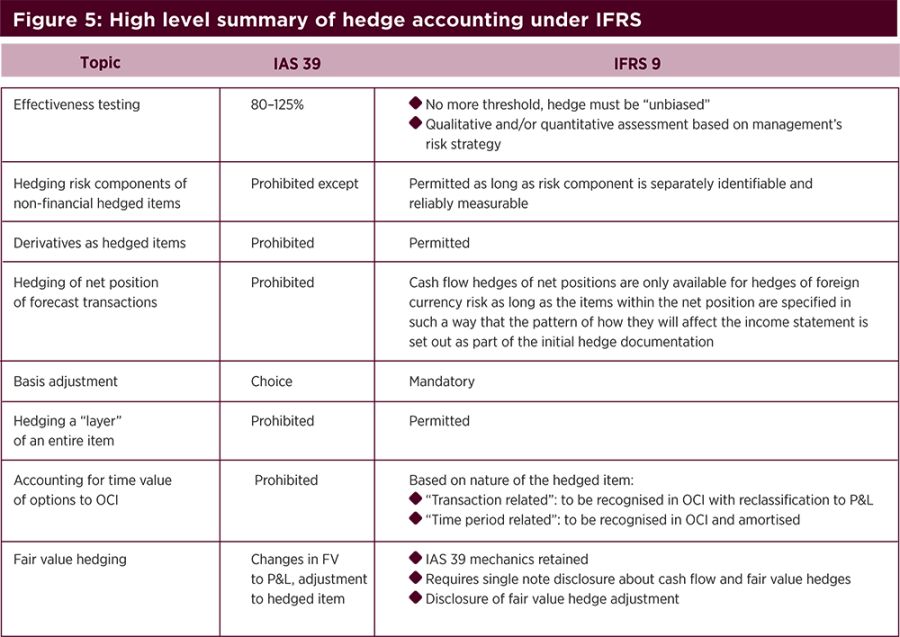

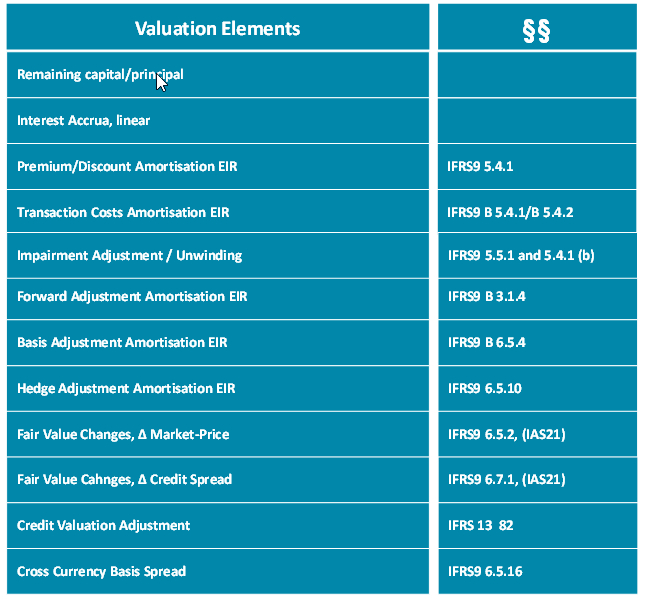

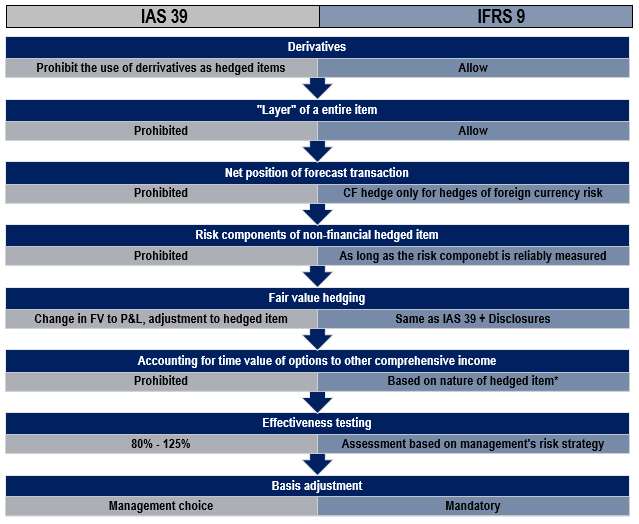

Key highlights of IFRS 15 and IFRS 9 for the asset management sector | Malta Asset Management Forum 2018 | Deloitte Malta