Measuring market and credit risk under Solvency II: evaluation of the standard technique versus internal models for stock and bond markets | SpringerLink

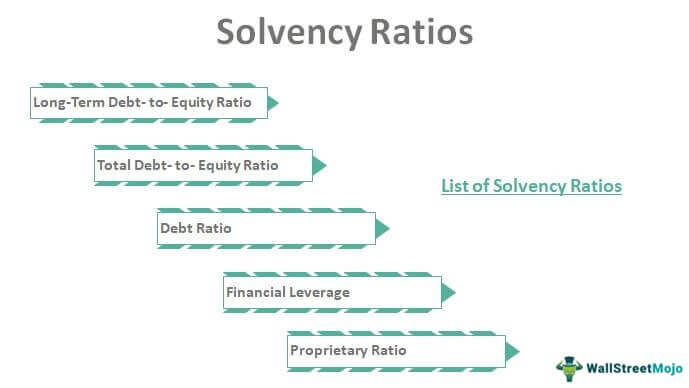

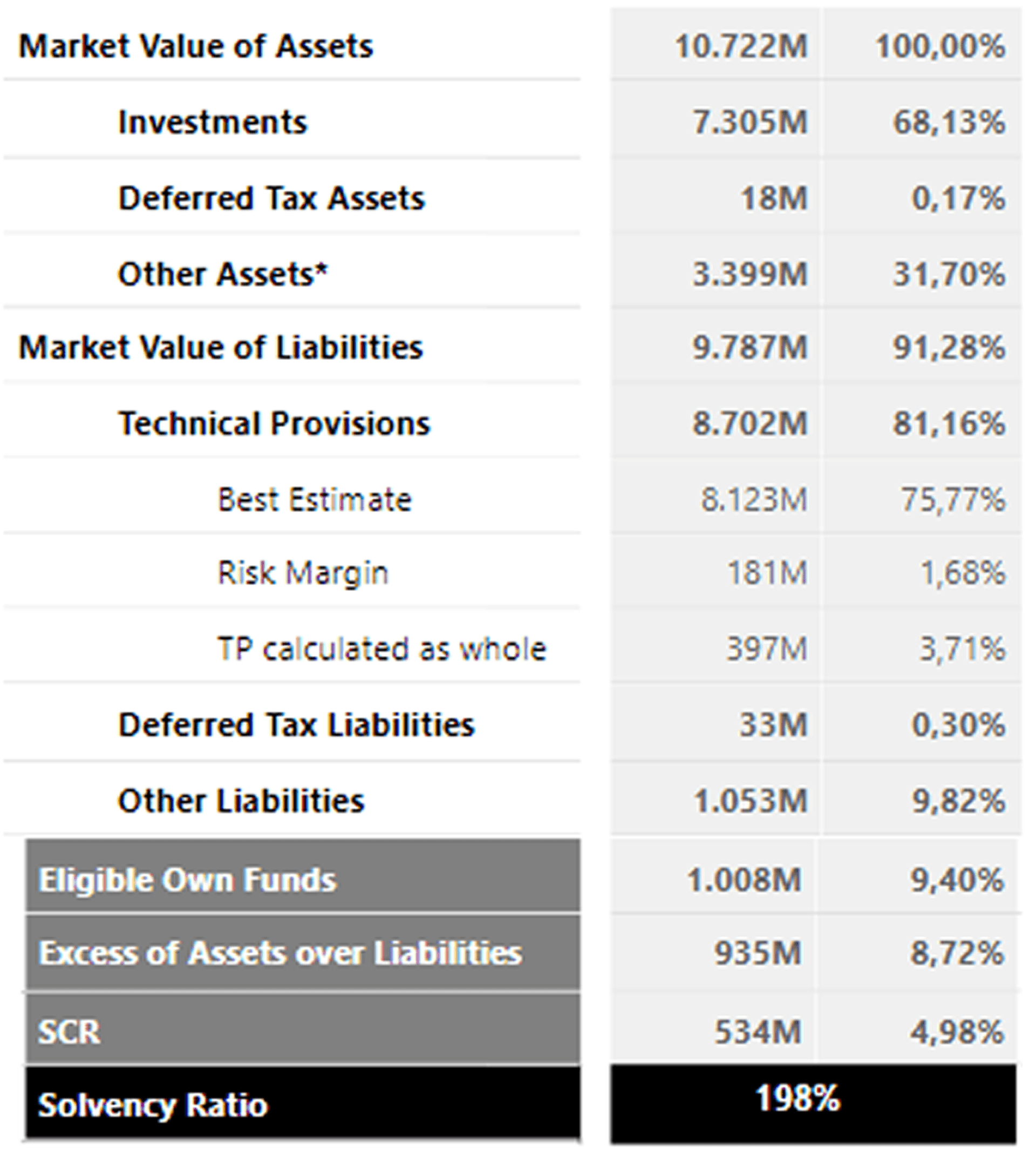

Spanish insurance market: Analysis of SCR, own funds and solvency ratios (2020) - Revista del servicio de estudios MAPFRE

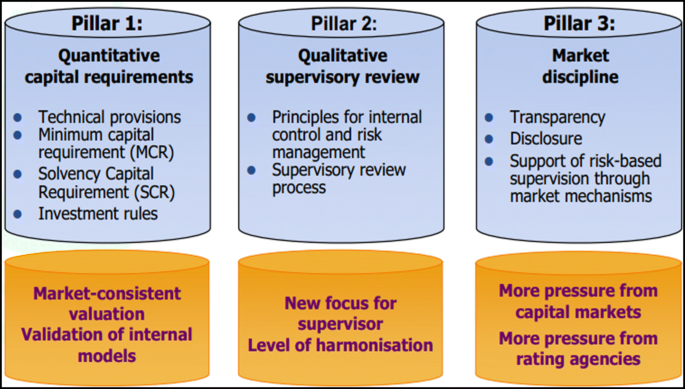

Example comparison of Solvency I Pillar 2 and Solvency II balance sheets | Download Scientific Diagram

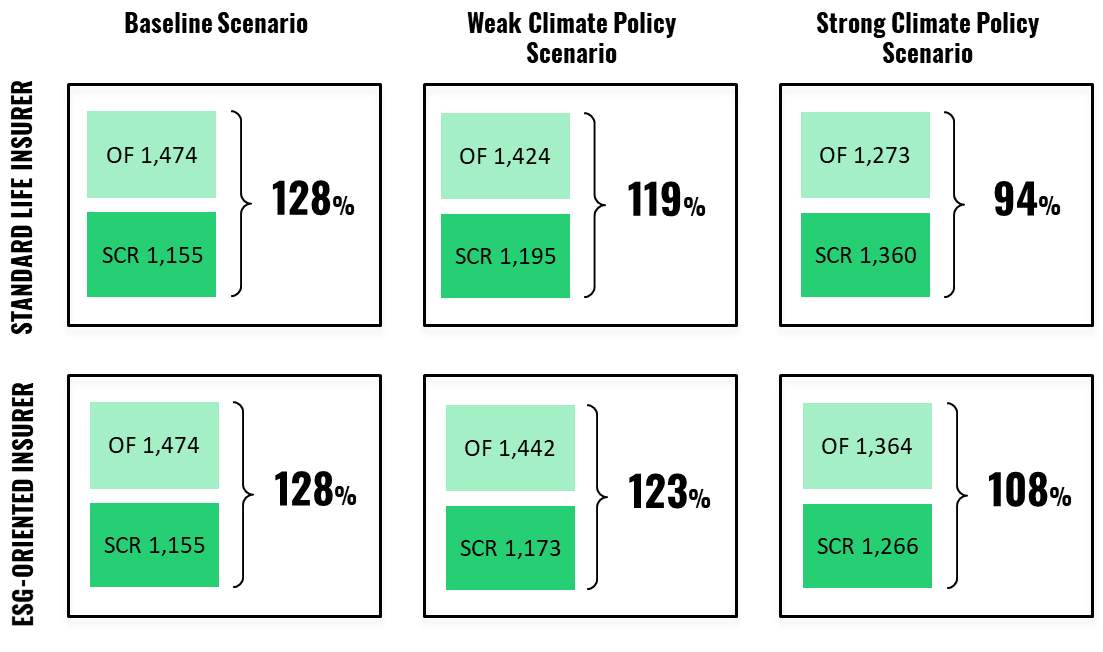

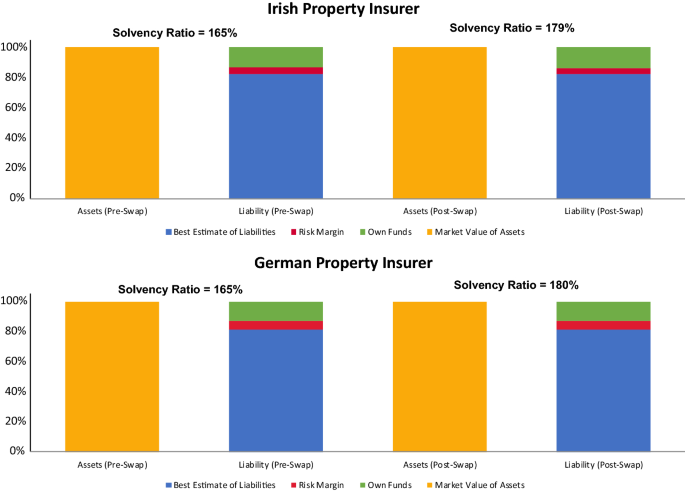

Diversification and Solvency II: the capital effect of portfolio swaps on non-life insurers | SpringerLink

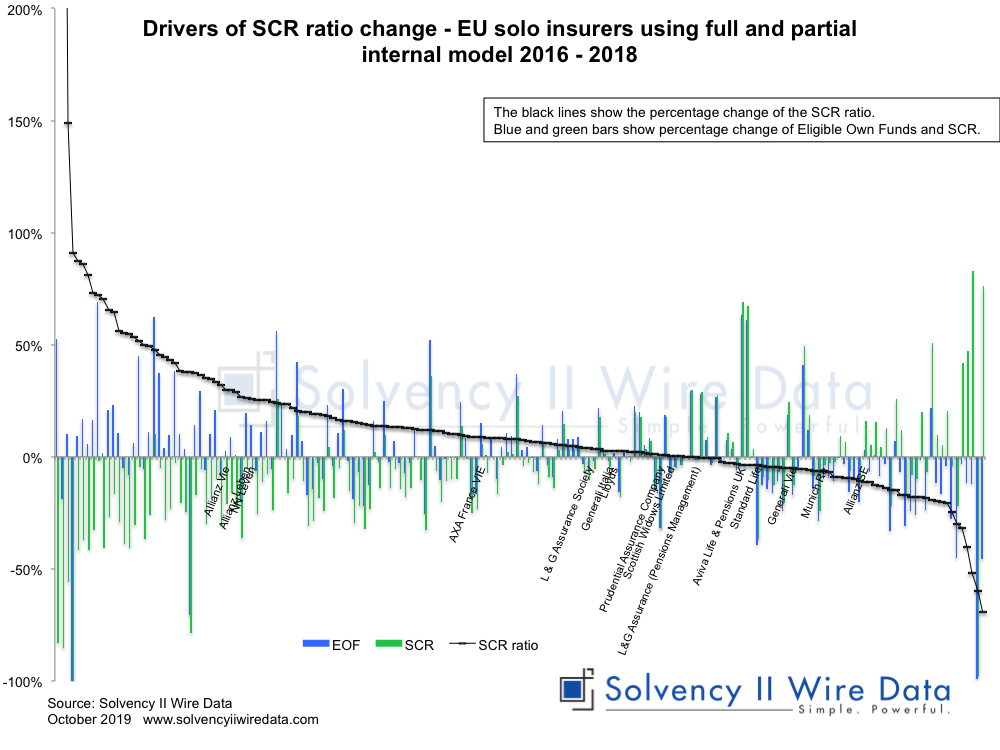

Drivers of SCR ratio change - EU solo insurers using full and partial internal model 2016 - 2018 • Solvency II Wire