Digital Overseas - Settle in Malta CALL :- 8487996094 #education #malta #consultant #studygram #abroadvisa #abroadjobs #student #digital #consultancyservices #pathway #ahmedabadinstagram #india #withoutielts #studyinmalta #maltauniversity #studysafe ...

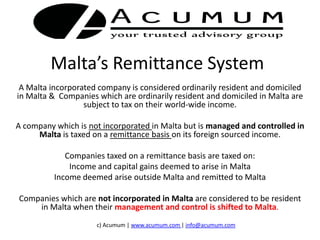

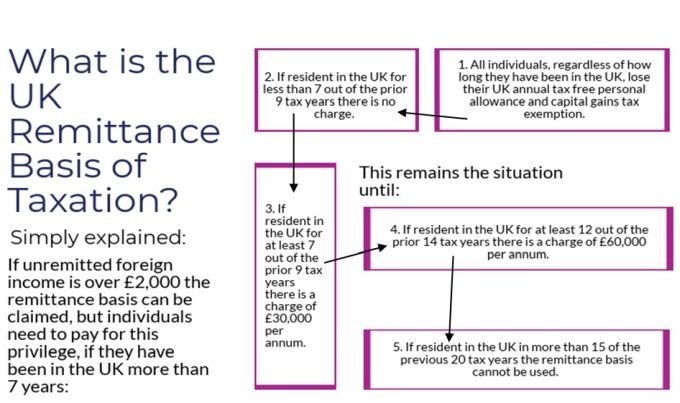

Malta: Commissioner publishes first ever guideline on remittance basis of taxation | International Tax Review

Minimum tax charge introduced for persons ordinarily resident but not domiciled in Malta | Chetcuti Cauchi Advocates Malta Law Firm

GMS Flash Alert 2015-105 Malta – Changes to Remittance Basis, Highly Qualified Persons Rules (September 9, 2015)

Fenech & Fenech Advocates - Malta operates a remittance basis of taxation for persons who are resident or domiciled in Malta for tax purposes. The Budget Implementation Act (Act VII of 2018),

![Offshore Tax ] Taxation of Non-Dom residents in Malta - YouTube Offshore Tax ] Taxation of Non-Dom residents in Malta - YouTube](https://i.ytimg.com/vi/U-h-_YlpCIo/sddefault.jpg)